The Ichimoku Price Theory is one of the most complex trading systems. The basics of the system are made up of three formulas and calculations. You should know that these are not absolute values and should only be used as a guide when trading. The system was originally meant to be used in conjunction with price action, and many aspects are based on price action patterns.

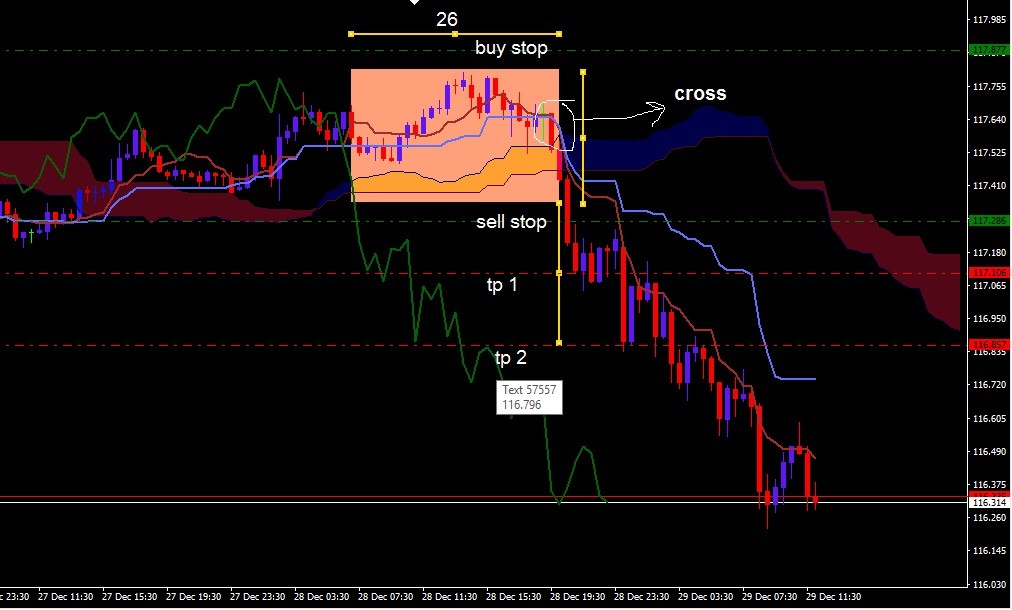

Using the ichimoku trader indicator is a great way to identify overbought and oversold zones in the market. The ichimoku indicator analyzes price movement and the Kijun Sen in order to determine whether the market is overbought or oversold. When the two indicators cross, it is an indication of a change in trend.

MT5 includes the ichimoku indicator. This technical indicator is a must-have for any trader. While the ichimoku indicator can provide many different signals, it can be difficult to use properly. As such, it is best to use it in conjunction with a variety of other indicators.

Another important indicator to use in conjunction with the ichimoku system is the chinkou span indicator. This fundamental indicator helps to filter out false signals in the ichimoku system. In this way, you can be sure that a signal is valid only after it is confirmed by a second indicator.

When analyzing the tenkan sen, an informed Ichimoku practitioner looks for an opportunity to enter a long position. Generally, this trader will wait for price to break point D, then enter the market again. However, if the price is unable to break point D, he or she will wait for another better trade opportunity.

The second line is the Senkou-Span B, which gives traders a clearer idea of where price is headed in the future. It also offers insight into future support and resistance levels X periods out. By crossing the two lines, you’ll be able to determine which trend is more likely to continue or revert.

The ichimoku graph is often very complicated, but the principle behind it is quite simple. The ichimoku graph’s Kumo indicator changes color depending on the position of the Senkou Span A and B. Essentially, it represents a divergence in price evolution.