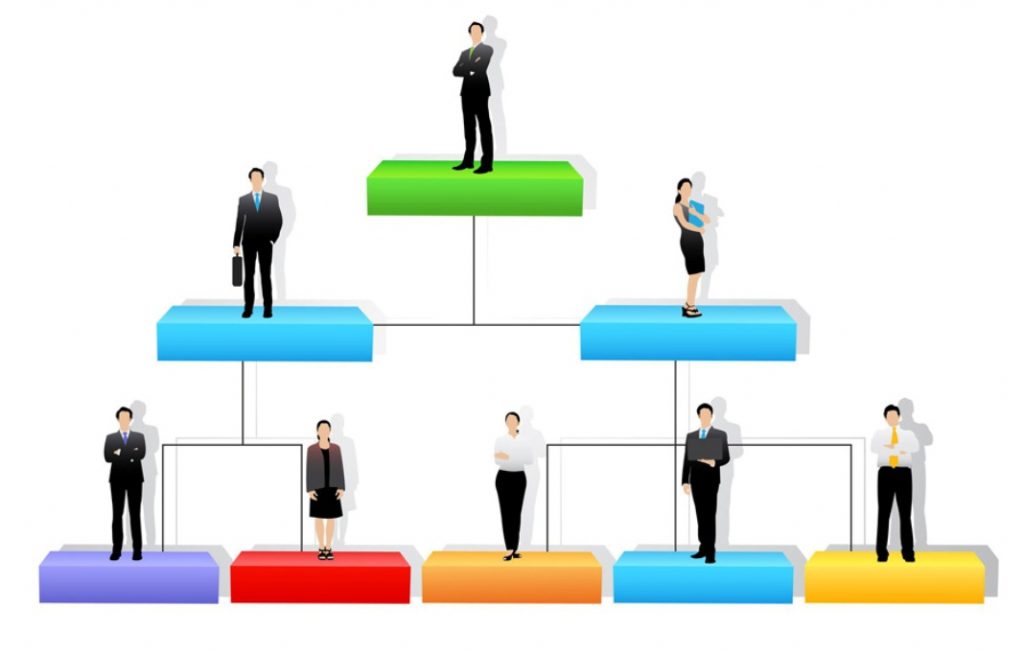

What Is Business Structure?

Business structure refers to the legal structure of an organization that is recognized in a given jurisdiction. An organization’s legal structure is a key determinant of the activities it can perform, such as raising capital, responsibility for business obligations, as well as the amount of taxes that the organization pays to tax agencies.

Before making a choice on the type of legal structure, business owners should first consider their needs and goals and understand the characteristics of each business structure. The four main forms of business structures in the United States include sole proprietorship, partnership, limited liability company, and corporation.

Visit here ownersites.com

Business Structure

Summary

A business structure describes a company’s legal structure that affects the day-to-day operations of a business.

A sole proprietorship and partnership are simple to set up because they do not need to meet ongoing requirements such as shareholder meetings and voting.

A corporation and a limited liability company provide their owners with limited liability protection, which serves to prevent the owner’s personal assets from being sold to settle the entity’s debts and liabilities.

as business structure

The various business structures are discussed in detail below:

Sole Proprietorship

A sole proprietorship is the simplest business structure and involves one person who is responsible for the day-to-day operations of the business. Also, from a tax perspective, the income and expenses of the business are included in the owner’s tax return.

The business is not required to file a separate income tax form from the owner as the business does not exist as a separate legal entity from its owner. The owner is required to file Form 1040, and the form must include Schedule C and Schedule SE for Self-Employment Tax.

There are many advantages to choosing a sole proprietorship business structure. First, it is cheap to start, and there are minimal fees when registering a sole proprietorship. In most states, the only costs associated with running a sole proprietorship are business taxes and operating license fees.

know more about these kinds of stuff here owner of namecheap inc

Business owners may also be eligible for tax deductions such as health insurance. Unlike a limited liability company, a sole proprietorship is not required to meet ongoing requirements such as shareholder meetings and voting or election of directors. On the downside, since it is not a separate legal entity from its owners, the owners will be personally liable for the business’s debts, liabilities, and obligations.

Partnerships

A partnership is a form of business structure involving two or more owners. This is the simplest form of business structure for a business with two or more owners. A partnership shares many similarities with a sole proprietorship. For example, the business does not exist as a separate legal entity from its owners, and therefore, the owners and the entity are treated as one person.

When filing taxes, business profits and losses are passed on to the partners, and each partner is required to report the information on Form 1065 with their individual tax return. In addition, partners are required to pay self-employment tax based on their share of the enterprise’s profits. Schedule K-1, which records profit or loss, must accompany Form 1065.

A partnership business structure offers many benefits. When registering a partnership, there is very little paperwork involved, and the partners are not required to meet the same level of requirements that limited liability companies are subject to. In addition, the partnership enjoys a special taxation regime, where the partners are required to report their share of the profit or loss of the business on their income tax returns.

On the downside, partners are personally liable for the business’s debts and obligations, and their personal assets may be sold to pay off the business debts. Also, there may be disagreements between the partners and this may slow down the conduct of the business.

Corporation

A corporation is a type of business structure that provides the entity with a separate legal entity from its owners. It is complicated and expensive to install, and it requires owners to comply with more tax requirements and regulations. Most corporations employ attorneys to oversee the registration process and to ensure that the entity complies with the laws of the state where it is registered.

When an organization intends to go public through the issue of common stock to the public, it must first be incorporated as a corporation. Corporations are required to pay both federal and state taxes, while shareholders are required to disclose their dividend payments when filing their personal income taxes.

The main types of corporations are C-corporations and S-corporations. A C-corporation exists as a separate legal entity from its owners, whereas an S-corporate

ION can consist of up to 100 shareholders and can function like a partnership.

One of the advantages of the corporate structure is the ability to raise capital. The entity can raise a large amount of capital by selling shares of stock to the public. Also, the business structure comes with limited personal liability, which provides protection to the owners from the debts, liabilities and obligations of the business.

On the downside, a corporation is subject to more requirements, such as meeting, voting, and election of directors, and is more expensive to form than a sole proprietorship or partnership.

Limited Liability Company (Llc)

A limited liability company (LLC) is a hybrid business structure that combines the best of both worlds, i.e., it has the characteristics of both a partnership and a corporation. It provides personal liability protection to business owners while reducing tax and business requirements. Business profits and losses are passed through to the owners, and each business owner is required to include a portion of the profit/loss on his personal tax return.

Also, unlike an S-corporation, which is subject to a limit of 100 shareholders, there is no limit to the number of shareholders in a limited liability company. When registering a limited liability company, the entity must file its articles with the secretary of state where it intends to do business. In some states, the entity may be required to file an operating agreement.

One of the advantages of setting up a limited liability company is that it comes with fewer requirements than a corporation. There is less paperwork involved, and owners enjoy limited liability, which protects their assets from having to be sold to pay the entity’s liabilities. A limited liability company is not subject to any limit on the number of shareholders it can appoint.

On the downside, a limited liability company is expensive to set up because it must register with the state where it intends to operate. In addition, the entity may need to hire an accountant and an attorney to ensure that it complies with tax and regulatory requirements.

,